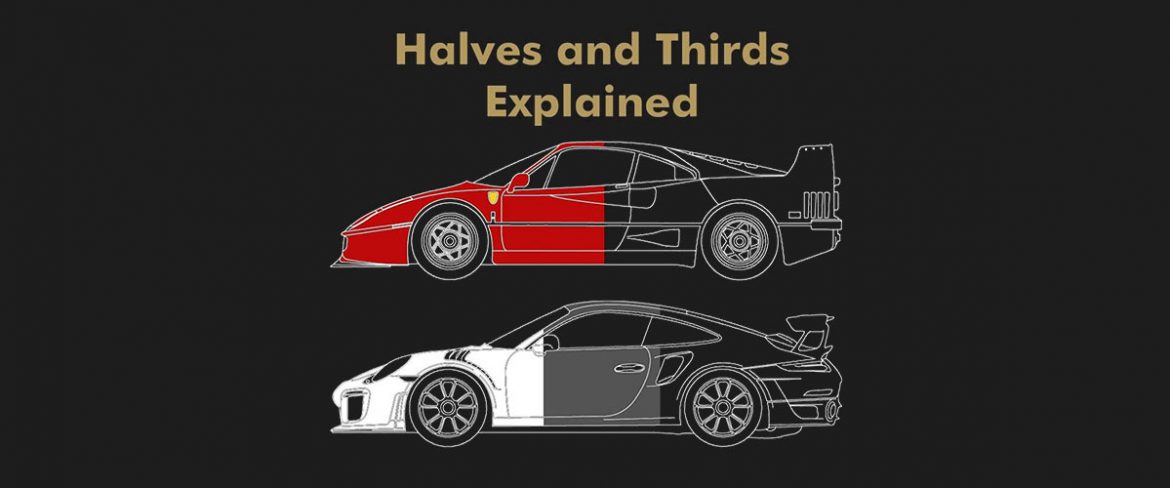

Halves & Thirds, Explained

Termination: Your rights

Our latest article in the series of Finance Explained looks at a relatively unknown clause in a Regulated finance agreement called the Halves and Thirds rule, often listed under the terms and conditions of a document with the sub heading of Termination – Your Rights.

The clause often referred to as the VT (Voluntary Termination) clause, is applicable to a Regulated Hire Purchase agreement. This should not be confused with early or partial settlement which it often is. Most finance agreements are ambiguous, to say the least, and omit clarity differentiating between the two. So, what does it actually mean?

The half rule gives the purchaser the option to voluntarily terminate the agreement once. This option is available once half of the total amount payable has been made prvided arrears are up to date. The third rule gives the purchaser further protection. If one third of the total amount is paid, a court order would be required to repossess the goods in the event of a delinquent account. If one third of the total amount has not been paid, the goods can be repossessed by anyone, at any time.

Why does this clause exist?

The clause exists to protect you against being sold goods that depreciate faster than the finance is being repaid.

How does it work?

Provided you have paid at least 50% of the total amount owed and the goods are in reasonable condition, you can write to the lender stating your wish to return the vehicle.

Why would I use the VT clause?

Let’s assume that when you bought the car, you were sold an unattractive finance deal. Unattractive by way of a small deposit and long term against a car that is going to depreciate faster than you are reducing your debt. In most cases, the clause is used when the car is worth less than the debt against it – what we refer to in the trade as being “the wrong way up”!

Does this affect my credit file?

Technically not, although a VT marker may appear on your credit file which may discourage lenders working with you in the future. Event though you may have a valid reason, you may be asked to explain why.

Are there times when this clause won’t work for me?

Yes, there are, and it is something we are increasingly experiencing. We have recently witnessed agreements where the profile has a minimal deposit and disproportionately high balloon payment at the end. Even though you may have been enjoying lower monthly payments, you will never reach the 50% of the total amount payable required to VT, as this is locked into the balloon payment.

Our Recommendation

Always take care to analyse the offer you receive. Have it explained clearly and ensure you understand your obligations under the agreement, taking legal advice if necessary. If an offer looks too good to be true, it probably is.

We know finance isn’t always easy to understand. Give us a call and we’ll do what we can to help.