Can technology help assess or predict classic car prices?

The business of selling cars has remained largely unchanged since the car was invented – or maybe even before that, if you include horse trading. The big question has always been ‘what is it worth?’ and this is still often determined using the tried and tested method of sticking a finger in the air and adding some.

While there is a degree of price transparency when buying a ‘normal’ car due to the existence of car valuation guides and large numbers of similar cars to benchmark against, there has been no easy or reliable way for UK classic car buyers to research classic car prices or understand what was going on in the market – but technology may change that.

“The danger of this kind of information to the industry is that people consider it definitive – I have heard it described as such by a pundit”

Many of us have become accustomed to monthly updates from the HAGI (Historic Automobile Group International) Index telling us how well a given subset of collector cars have performed compared to the stock markets, but it always seemed cloaked in mystery to me and a little too ‘bankerish’ and dry in tone. After all, these are cars we are talking about, not an ‘asset class’.

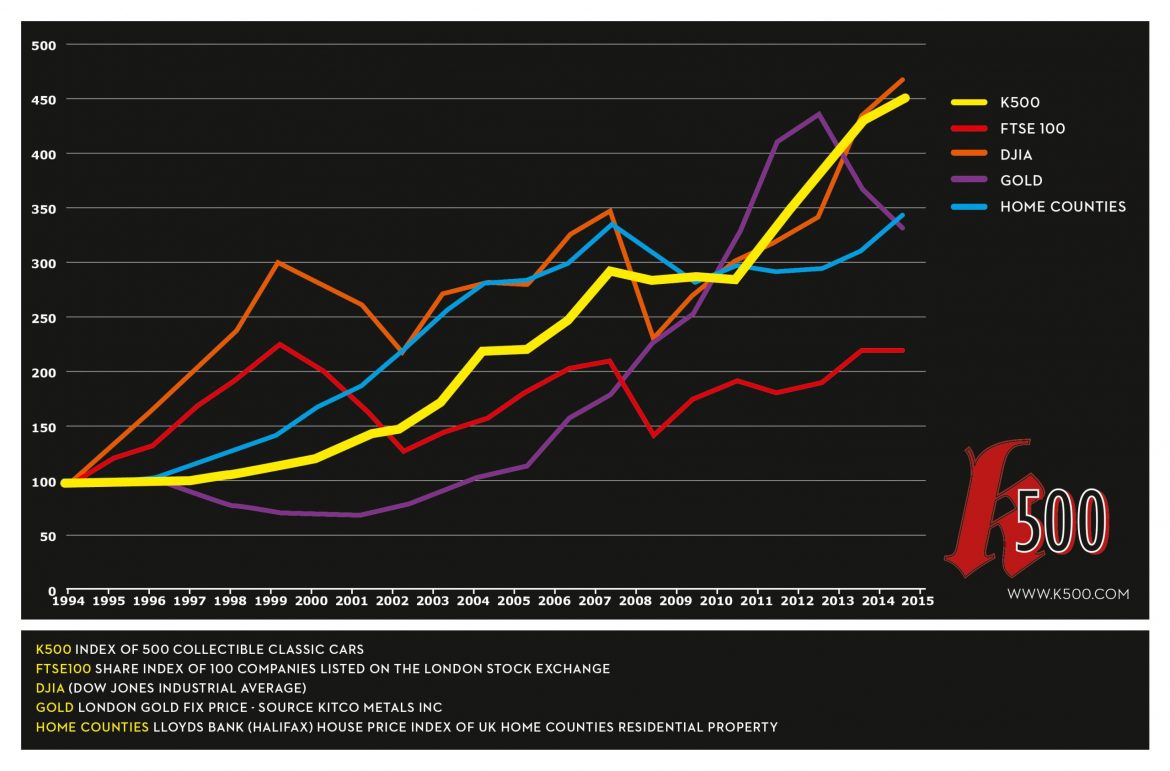

In recent months, we have seen a number of new classic car price tracking websites and services appear including the K500 index, Classiccarprice.com and even a new health-of-the-market indicator – the Hagerty Market Rating. K500 and Classic Car Price put a variety of information at the your fingertips (for a fee), including prices achieved at auction, some useful editorial and trends and statistics on the classic car market. K500 even allows you to compare your classic car portfolio (sorry!) against the rest of the collector car market.

Hagerty’s Market Rating is very interesting and probably more relevant as it uses factors other than auction results (the price of gold, expert opinion, private sales data) to rate the strength of the North American collector car market. But what does this online technology bring to the party, however modern and exciting it may seem?

“until technology can tell us what will happen to the market in the future rather than the past, classic car indexes and their ilk will provide impressive looking graphs for investment managers”

It doesn’t take a team of technology boffins to tell most of us what we already know – that prices have gone up and that Ferraris have lead the charge. The danger of this kind of information to the industry is that people consider it definitive – I have heard it described as such by a pundit who appears to have ignored the fact that around 90% of cars sales results are excluded.

As a wise man said, ‘you can’t stop two people going to an auction and getting dumb’, so if we are truly to rationalise classic car values then someone out there needs to step up and start tracking a larger data set – and when they do I’m pretty sure finger-in-the-air valuations will still reign supreme.

In the meantime, and until technology can tell us what will happen to the market in the future rather than the past, classic car indexes and their ilk will provide hours of fun for the bobble hat brigade, impressive looking graphs for investment managers and a welcome source of statistics for people who write about classic cars…

This article first appeared on Goodwood Road & Racing on January 28 2015.