Classic car market update – August 2017

On the 15th July 1897, newspapers in the US reported that vast quantities of gold had been found in the Klondike region of north West Canada. By 1899, an estimated 100,000 prospectors had made the journey to the region. In 1898, the Klondike Gold Rush faded from the headlines as newspaper editors lost interest and focused on the outbreak of the Spanish-American War. By 1899, the Klondike Gold Rush was over.

The media and the classic car market

We’ve had a considerable number of phone calls over the last month from the media asking us about the current state of the classic car market. This is nothing unusual in itself – what is unusual is that our observations aren’t making it into print.

This might have been us…

Why not? Because we’re not subscribed to either of the two established scenarios that make for good headlines (and strong car sales). They are:

Classic cars continue to skyrocket in value / make a great investment

Classic car values slump / less cars hitting estimate at auction.

As a wise man once said, everyone likes to talk about money and classic car values have provided a convenient fiscal conversation point for the media over the last few years – but for how much longer, and how will they choose to present the facts in a market where not a whole lot is happening?

The general outlook

Volumes of transactions and enquiries can be described as healthy after a brief hiatus around the general election. These are in the main for more modern vehicles under £100,000. “Investment” cars – those over £250,000 which were the key focus of speculators – have in many cases dropped back in price by 10-20% and more in the last 3 months. Modern collectables such as the Ferrari 458 Speciale and LaFerrari have come off the boil.

There is much talk of “under the radar” deals in the industry – we have certainly seen some evidence of this, but whether this is simply a distraction remains to be seen. If collectors are asking dealers to sell their cars under the radar, it begs the question “Why now?”

In the affordable classics sector (sub £100,000) prices continue to flare periodically for the cars du jour such as fast Fords which are being heavily promoted by auction houses and dealers. Silverstone Auctions’ recent (and successful) Silverstone Classic sale illustrates this trend very well. The cost of entry to this market – where much of the media hints at the opportunities for new found riches (see above) – is relatively low, just as it was for the prospectors panning for gold in the creeks of the Yukon. Like the prospectors, if you are in it to make money, remember that you may leave empty handed……

“…there are still some pockets of sterling opportunity. Ferraris and other high-end sports cars from the ’80s and early ’90s are gaining momentum as the darlings of newly rich millennials. These so-called modern classics have yet to reach peak prices, which means diligent buyers can find relative deals on such models as a Ferrari 308…” – Bloomberg. Confusing & incorrect – read the full article here.

Not all classic cars have investment potential

Many experienced buyers are now sniping some really great cars for good prices from auctions and buying sensibly from dealers. Feedback from our customers indicates that these cars are typically being bought to use, not as an investment. Whether they become more valuable over time remains to be seen, particularly after the government’s decision to ban the sale of all new vehicles with petrol or diesel engines by 2040. Inexperienced buyers beware.

The Classic Car Indices

The Classic & Sports Index

Our index is based on confirmed invoice prices, enquiries and customer sentiment.

Although finance enquiry levels remain healthy, the volume of “big” cars being bought and sold has reduced since 2015/2016. Activity remains strong in the affordable classics sector. Feedback from dealers indicates that business levels are variable and many report that they are busy with private transactions on cars that are not on the open market. Stock levels remain high and feedback from customers suggests that buyers are willing to hold back and wait for the right car at the price that suits them. Many cars currently on the market will need to look like better value for money to sell, and a considerable number of UK cars are being offered at the Monterey sales this August

Q3 outlook – Buyers market. Sellers of average cars will need to ensure their cars are priced competitively as prices soften – although this is unlikely to happen in the short term. High quality, truly collectable classics will continue to comand strong prices. Affordable classics will sell well for the time being but pricing will be key. Limited production modern classics and homologation specials will continue to attract the attention of investors and speculators. Buyers should negotiate hard and be prepared to wait for the right deal.

K500 Index vs CSF Index of most commonly financed classics

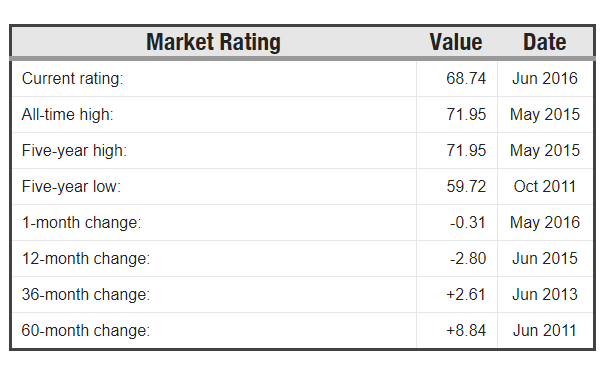

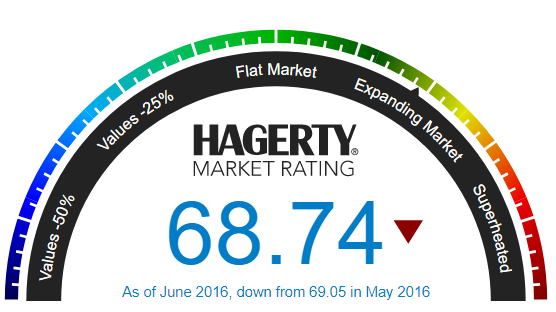

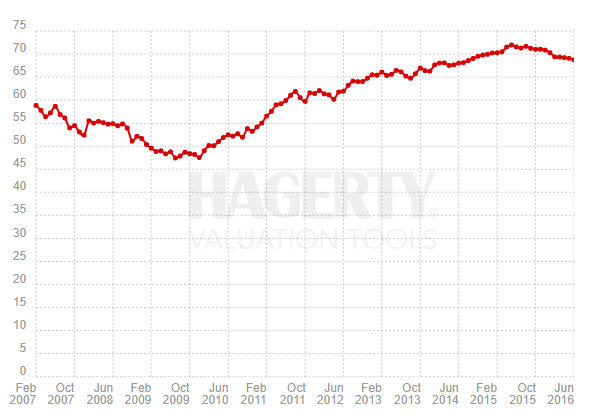

Hagerty Market Rating (US)

Hagerty’s US market rating decreased in June 2017 for the reasons they give below:

Following a very slight increase last month, the Hagerty Market Rating is down to 69.01 for June.While last month marked the largest increase of 2016 in the auction channel, auction activity instead saw its largest decrease so far this year for June and is currently at a 33-month low.

Private sales activity fell for the third consecutive month. Over the last 12 months, the average private sale price has fallen 10 percent and the percent of vehicles selling for above their insured values has fallen 1.4 percent.

Requests for insured value increases for broad market vehicles declined for the ninth consecutive month. Requests for insured value increases for high-end vehicles fell for the second consecutive month and are at a 15-month low.

HAGI index

The HAGI Index reported a decline in their TOP 50 Collector Cars Index of around 1.76% since Q1 (March) – a total decrease of 4.3% Year To Date but up 2.47% Year On Year.

Their Ferrari (HAGI F) index decreased 4.4% in Q2 – down 4.5% YTD and down 0.73% YOY

The Porsche (HAGI P) fell by 4% this quarter – YTD the index is down 6.73% and 6.08% down in the last 12 months.

The HAGI MBCI (Mercedes-Benz) index increased by 5.57% in Q2 – up year on year 13.9% and YTD up by 8.43%.

HAGI TOP excluding Porsche & Ferrari increased 1.1% in Q2 2017 – down 3.05% YTD but up 2.58% YOY

K500 Index

The K500 market average index stands at 478.75 from an opening position on 1 December 2014 of 449.9 – a slight drop from last quarter but a static market overall.

None of the individual vehicle indexes rose.

Many thanks are due to John Mayhead at Hagerty Insurance UK , Deitrich Hatlapa of HAGI and Steve Wakefield of K500 for their feedback, support and cooperation.