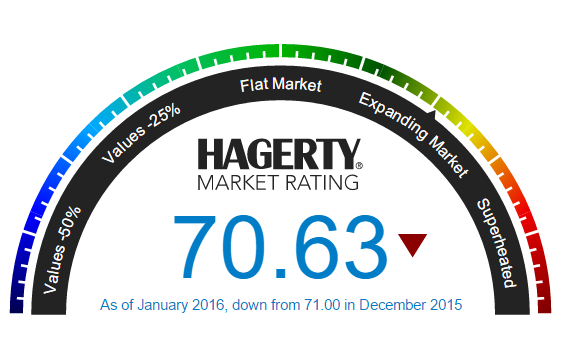

The Hagerty Market Rating – January 2016

Hagerty’s US barometer of the heat in the classic car market has declined in January due to the following reasons given by the classic car insurance specialist.

The Hagerty Market Rating is down for the second month in a row, and has been down for seven of the last eight months. The 0.37 drop from December is the second largest month over month drop in the last year.

After remaining flat last month, Expert Sentiment is up slightly. In particular, optimism was expressed for the lower and middle levels of the market.

The Hagerty Price Guide section of the Hagerty Market Rating also saw a small increase, slightly outpacing projections.

Auction activity experienced the biggest drop of any section, as the number of cars sold is at the lowest point of the last 20 months.

Private sales activity also decreased, and has done so for the fourth straight month. The average private sales price is also the lowest it’s been in the past year.

Increases in high-end insured values fell for the fifth month in a row, while increases in broad market insured values saw the biggest month-over-month drop in three years.

December’s reported rating was revised to 71.00 from 70.84 due to newly released inflation numbers.

What does this mean?

Well, as you would expect sales activity at auctions and elsewhere is down as it typically is coming into the winter and festive periods. Expert sentiment is up, most likely due to the further consolidation of the market. The HAGI indexes all closed YOY from their closing positions in 2014 and it is interesting to cross reference the slowing price growth with the slightly cooling market sentiment represented by the Hagerty market rating.

The Classic & Sports Index

Our index is based on invoice prices, enquiries and customer sentiment.

Speculator activity cooled in the last quarter of 2015 but many dealers are anticipating renewed interest due to oil price and stock market fluctuations. Whether this will prove correct remains to be seen but we have seen a lot of dealer and classic car finance activity through the Christmas and New Year period – more than we would normally expect. It is also interesting to note that these have typically been for substantial collector cars rather than the more affordable classics that are doing very well at the moment

Outlook – positive. Consumer interest is still strong but we do not expect the wholesale price rises the market experienced in 2015.

Many thanks are due to Hagerty UK for their support and cooperation in allowing us to share their data. We hope to extend this direct sharing of information to the other indices in the very near future.