The classic car market – March 2017

No news is good news unless you are a headline writer for a classic car magazine.

The message from all our market-watching partners is the same – there isn’t much to report on. Modern classics are good news, pre-war and post-war cars are having a bit of a revival, transactions in the mid-market have slowed down and opportunities for investors to flip cars for a profit are limited. Good news for enthusiasts, then.

It seems like an age since all classic car were being reported as rocketing up in value. The reality is that the market is stable and “flat” probably best describes the £150,000+ market. The Scottsdale, Paris and Amelia Island auctions have demonstrated that in the £5 million+ arena collectors are exercising caution and are looking for fresh to market cars with impeccable provenance. Investor numbers have dwindled which leaves the enthusiasts to set the prices for the cars that they wish to buy.

Don’t be mistaken, though – cars are selling.

The volume of cars selling at auction is high on both sides of the pond and despite the fact that the supply of the best and most interesting cars has dwindled sell-through rates at auction continue to impress. The total values sold do not reflect the record-breaking years of 2014 – 2015 but the cars that are being sold are generally simply not as good and therefore less valuable. Sellers are still clinging on to 2015 estimates, so the number of cars selling under estimate is high but the prices achieved are realistic.

Younger cars, younger buyers.

It has been said time and time again but we are going to reiterate – modern classics are where the action is. The Ferrari Daytonas and 275s are no longer the focus of attention for well-heeled collectors at the moment and the 993 GT2s, 911 GT1 and modern collectables such as LaFerrari are hot property.

At the other end of the scale, modern hot hatches and the “hooligan” cars of the eighties, nineties and noughties are great news, especially if the mileage is low and provenance and condition high. Eminently affordable, they are also eminently usable and connect buyers to their misspent youth.

“He who dares wins, Rodney…”

If you are in a position to buy now is a good time to have a look around. Many dealers are willing to cut a deal and prices for certain models are 10-15% down from their peak even if the price tag doesn’t reflect that.

At Historic’s March auction at Brooklands we saw some buyers pick up genuine bargains (we thought the XK150 and 911 SC were a steal) and many sellers will have been delighted with the outcome of their sale. We believe this perfectly encapsulates the market at the moment. The overpriced and less-than-great cars languishing at nouveau-classic car dealers will begin to trickle back to their owners in due course or end up selling under the table for the right money.

Right car. Right Price. Right people.

As always, the best cars at the right price remain with the best specialist dealers and these guys are not afraid to price cars correctly for the market, so don’t be surprised if you see cars that look like good value at the best known dealers. The very best will continue to command a premium, though.

The Classic Car Indices

The Classic & Sports Index

Our index is based on confirmed invoice prices, enquiries and customer sentiment.

The first quarter of the year is traditionally quiet for the classic and performance sector of the used car market place. This is reflected in the feedback we have had from dealers although some are reporting buoyant sales and we are aware that an increasing number of cars are leaving the UK due to the exchange rate. Buyers of mid-market cars are less active than a year ago, although auctions in general continue to achieve healthy sell-through rates. The affordable classic segment continues to thrive.

2017 outlook – Steady. Desirable/ limited production modern & affordable classics continue to sell well. Room for negotiation on prices in most cases. Many cars less expensive than 18 months ago but not all.

The Classic & Sports Finance Index – the most popular models that we finance. This graph represents those models included in the K500 index

Hagerty Market Rating (US)

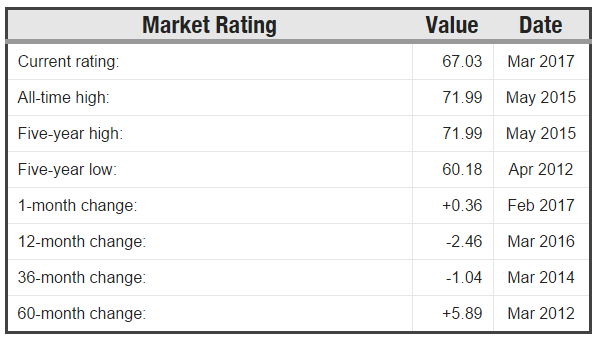

Hagerty’s US market rating increased in March 2017 for the reasons they give below:

The Hagerty Market Rating experienced its first increase of 2017 for March with a small jump of 0.36 to 67.03.

Auction activity saw another increase, and this month was the largest month-over-month increase in the last four years. This is largely thanks to a steady increase in the number of cars offered over the last six months and a 6% increase in the number of cars sold over the last 12 months. It’s a different story on the private market, however, as the average sale price is down 7% over the last 12 months.

The number of owners expressing the belief that values of their vehicles are rising continues its steady decrease. This is true for the owners of both mainstream and high-end vehicles, although the drop was more pronounced for owners of high-end vehicles.

These drops come despite small but steady increases in expert sentiment and some fairly encouraging external market forces, including the current strength in the stock market.

HAGI index

The HAGI Index reported increases in their TOP 50 Collector Cars Index of around 0.52% in March – a total increase of 0.12% Year To Date but up 12.3% Year On Year.

Their Ferrari (HAGI F) index decreased by 1.6% – it remains up 3.2% YTD and up 10.87% YOY

The Porsche (HAGI P) increased 0.56% in March – YTD the index is down 1.61% but up 13.24% over the last 12 months.

The HAGI MBCI (Mercedes-Benz) index increased by 2.43% – up year on year 8.63% but YTD up by only 0.93%.

HAGI TOP excluding Porsche & Ferrari declined 0.48% – down 1.89% YTD but up 13.27% YOY

K500 Index

The K500 market average index stands at 483.1 from an opening position on 1 December 2014 of 449.9 – a slight drop from last quarter but a static market overall.

According to the index:

Pre-war European cars are up

Affordable classics continue to rise (but only just)

Post ’73 Ferrari are up

Many thanks are due to John Mayhead at Hagerty Insurance UK , Deitrich Hatlapa of HAGI and Steve Wakefield of K500 for their feedback, support and cooperation.